- Life Insurance

- Income Protection

- Superannuation

- Superannuation Insurance

- Super Fund Income Protection

- SMSF Insurance

- SMSF Life Insurance

- SMSF Income Protection

- Wealth Smart’s Superannuation Employer Contribution Solutions

- Super Centre

- Consolidating Your Super

- What is Super?

- Salary Sacrificing Super

- Concessional contributions cap

- Your Investment Strategy

- Our Solutions

- Corporate Employee Solutions

- Private Client Solutions

- General Insurance

- Resources

- Insurers

- Contact

- Superannuation Insurance

- Super Fund Income Protection

- SMSF Insurance

- SMSF Life Insurance

- SMSF Income Protection

- Wealth Smart’s Superannuation Employer Contribution Solutions

- Super Centre

- Consolidating Your Super

- What is Super?

- Salary Sacrificing Super

- Concessional contributions cap

- Your Investment Strategy

- Our Solutions

- Corporate Employee Solutions

- Private Client Solutions

Recent Posts

Categories

What is salary sacrifice into Super and how does it benefit you?

Australian Attitudes towards Life Insurance Not Enough

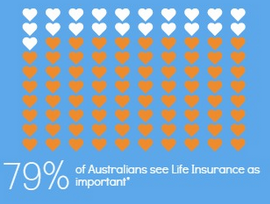

Wealth Smart partner provider TAL has revealed in its recent survey that while 79% of Australians view Life Insurance as valuable protection, only 52% actually hold any cover.

Just as frightening, the survey found those seriously lacking proper cover are generally people with the most at risk and with the most to lose.

Mortgage holders are most likely to recognise the importance of Life Insurance. But they don’t fare any better than the rest of the survey respondents when it comes to having enough cover to protect themselves and their families.

Bittersweet Results

TAL Group CEO Jim Minto said in a statement from the company that the results were bittersweet. He said he was encouraged that Australians valued insurance, but still worried about the lack of protection among Australia’s most vulnerable.

“On the one hand it is encouraging that people recognise the vital role of life insurance but the relatively low protection levels reflects just how much work is to be done educating the community about the need to protect themselves and their families.

“… Having appropriate protection shouldn’t stop once the mortgage is paid. Having protection such as critical illness insurance, which can finance special treatments, pay everyday bills and for costly rehabilitation and modifications such as wheelchair access remains relevant long after the home is paid off.”

At Wealth Smart, we’ve always advocated having proper Life Insurance measures in place. These scary statistics showing that only half of adult Australians are covered in the event of death or serious illness and injury is worrying.

For Mr Minto – and for us here at Wealth Smart – the solution is in the way we talk about Life Insurance, and in ensuring our clients know the importance of being protected.

We echo Mr Minto’s sentiments:

“Overall, however, it is hard to reconcile that most people understand how important it is to protect their lifestyles and their families’ financial wellbeing, but at the same time are not taking the action they need to do so. We just need to overcome this gap through more education and information.”

If you’re one of the 48% of Aussies who doesn’t hold any cover, find out how you can protect yourself and your family in the event of a serious injury, illness or death by getting in touch with one of Wealth Smart’s expert advisers.

Read the full results of the TAL Survey here.

Find out more about getting the best insurance for your by downloading our FREE comprehensive Life Insurance eBook!